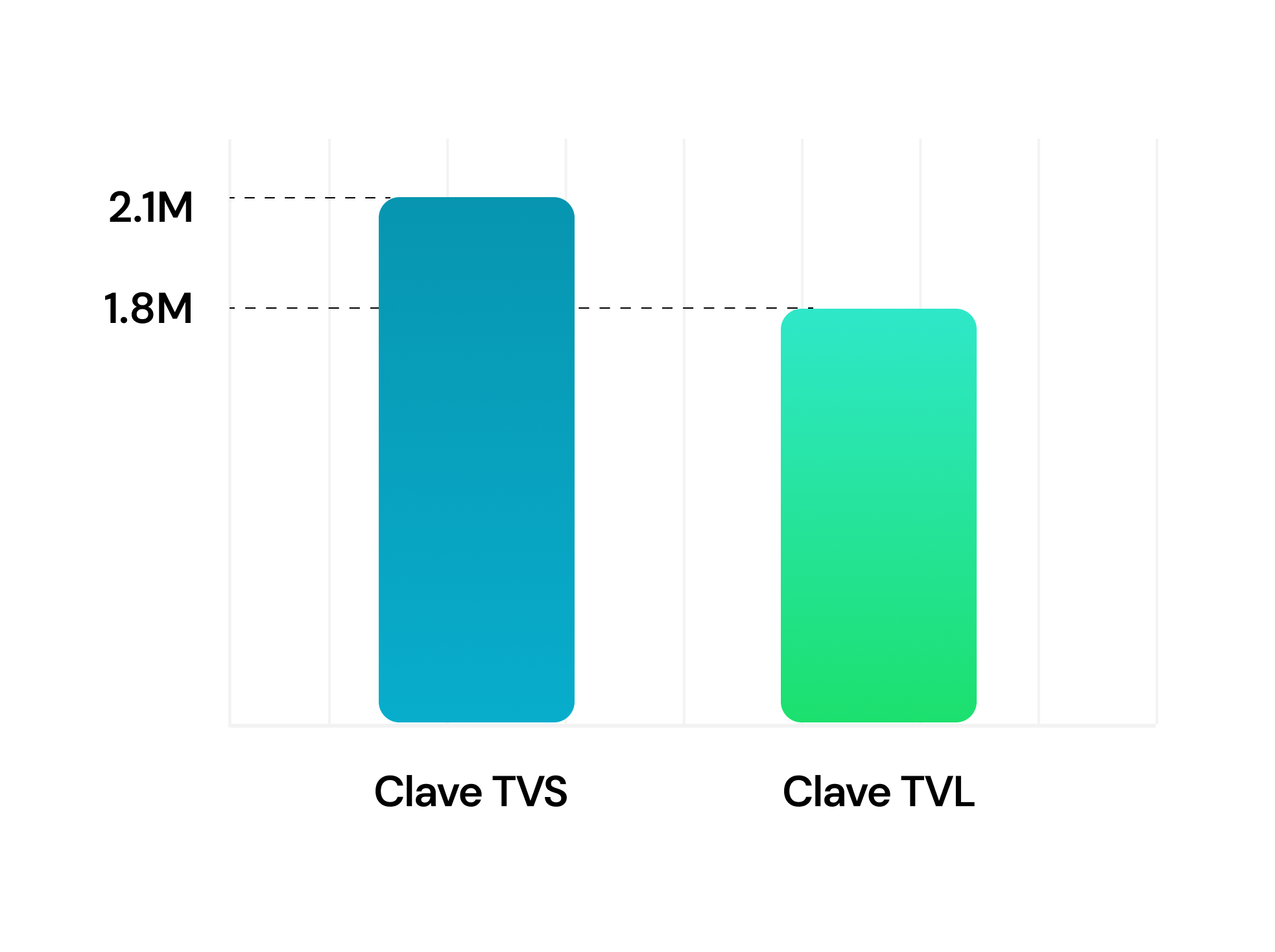

Clave was launched four months ago and has quickly gained traction, with 15,000 downloads and over $2 million in Total Value Secured (TVS). Impressively, 90% of these assets are actively utilized in DeFi through Clave’s Earn Hub. This strong performance validates our thesis that a user-friendly experience (UX) and an intuitive interface (UI) significantly drive user engagement with DeFi products. By simplifying access, Clave demonstrates that ease of use can play a pivotal role in encouraging more users to explore and invest in decentralized finance.

Do Users Really Use DeFi?

Decentralized finance (DeFi) stands out as one of the most promising use cases in the crypto space, having successfully found its product-market fit and playing a pivotal role in driving broader blockchain adoption. Despite its potential, the actual adoption of DeFi remains lower than expected. To better understand this discrepancy, let's delve into the statistics on Layer 2 (L2) networks and explore ways to enhance DeFi adoption:

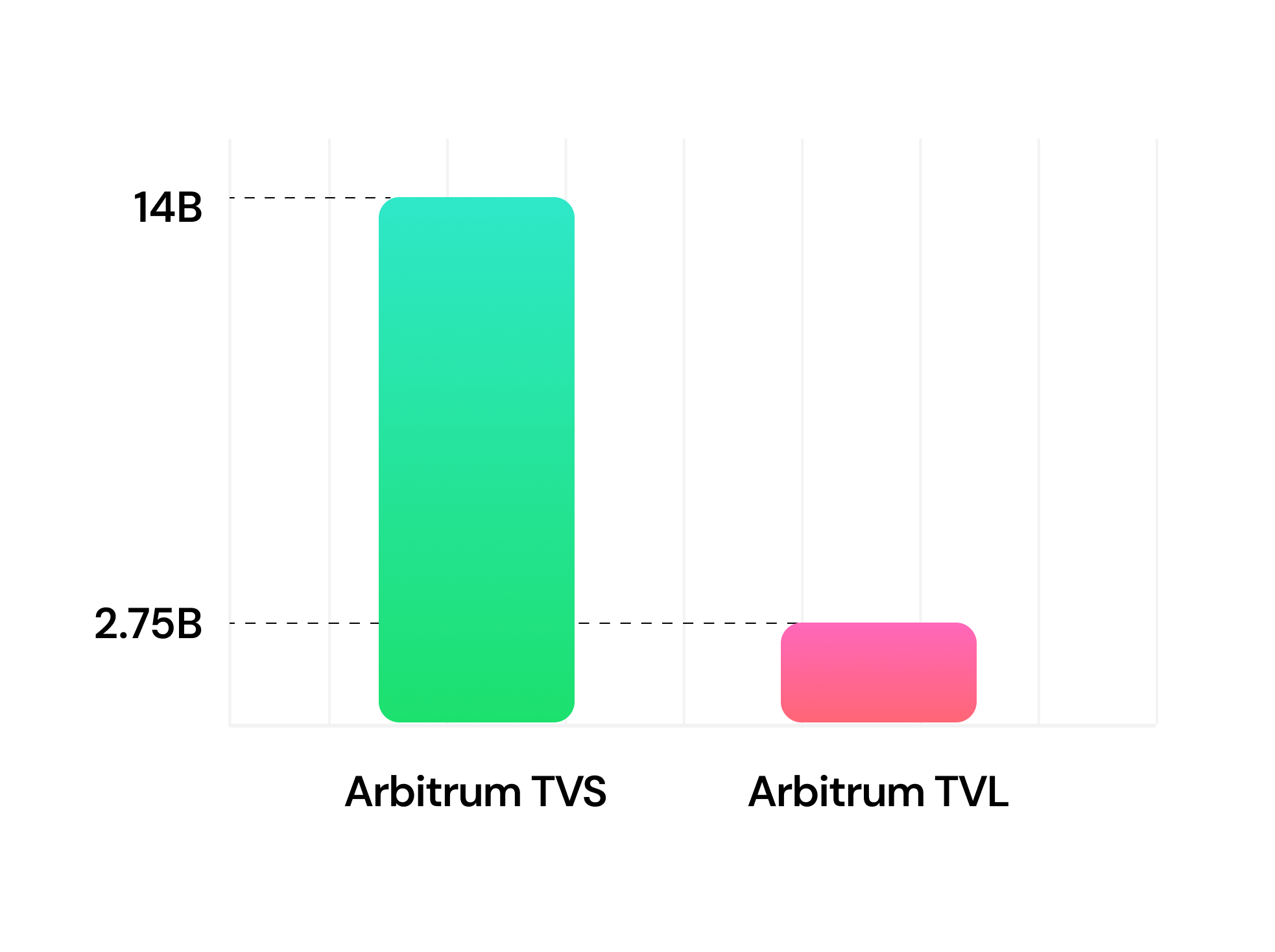

TVS vs. TVL on L2s:

Layer 2 rollups have become the primary venue for users interacting with Ethereum due to their low fees, security, and compatibility with the Ethereum network. Currently, Ethereum rollups collectively secure over $33 billion in assets. However, a closer examination reveals that DeFi usage within these networks is considerably low compared to the total value secured (TVS). This suggests that most users are not actively engaging with DeFi protocols.

For example, Arbitrum, a leading L2 rollup, boasts a TVS of $14 billion, yet its Total Value Locked (TVL) in DeFi protocols is only $2.75 billion. This stark contrast highlights a significant gap between the assets secured on these networks and those actively utilized in DeFi, indicating that a large portion of funds remain idle or in centralized parties.

This metric is crucial because increased utilization of funds within DeFi directly translates to higher liquidity, a foundational element for the scalability of onchain finance. High liquidity enhances the efficiency of financial markets on the blockchain, reducing slippage, lowering transaction costs, and enabling larger trades with minimal impact on price. As more assets are actively engaged in DeFi, it strengthens the overall ecosystem, supports more robust financial products, and attracts a broader range of participants, driving the evolution and scalability of decentralized finance on a global scale.

Improving DeFi adoption on L2s could involve addressing user experience barriers, enhancing the availability of DeFi products, and better educating users about the potential benefits of engaging with these financial tools. By focusing on these areas, there is a clear opportunity to convert more of the secured assets into actively utilized ones within DeFi ecosystems. SourceDefiLlama, L2beat.

The total value secured by all Ethereum rollups stands at $33 billion, yet the total value locked (TVL) is only $8 billion. This significant discrepancy highlights a substantial opportunity to capitalize on. By effectively engaging the untapped assets, there is potential to drive increased adoption and utilization within the DeFi ecosystem, creating avenues for growth and deeper integration of decentralized finance on Ethereum rollups. This gap in DeFi adoption exists due to several key challenges faced by retail users:

- Lack of Knowledge: Many retail users are unfamiliar with how to effectively use DeFi products, leading to hesitation and underutilization of available platforms.

- Impermanent Loss: One of the major deterrents is the risk of impermanent loss, which can significantly impact returns for users providing liquidity.

- Difficulty in Finding Optimal Pools: Retail users often need to sift through hundreds of pools to identify the most suitable one for their assets, which can be a time-consuming and daunting task.

- Complexity of Transactions: Providing liquidity or joining a pool typically requires executing 4 to 5 separate transactions, adding complexity and increasing transaction costs, further discouraging participation.

Addressing these barriers through user education, simplifying processes, and offering tools to mitigate risks could bridge this gap and unlock the full potential of DeFi for retail users, and this is what we’re trying to achieve at Clave!

The Earn Hub: Clave

At Clave, we are dedicated to overcoming the barriers that users face when accessing DeFi products. Our mission is to make open finance accessible to everyone, guided by key philosophies designed to simplify the DeFi experience:

- One-Click Staking with Clave: Leveraging the power of Account Abstraction, Clave consolidates multiple transactions into a single click, streamlining the process of joining DeFi pools and generating yields effortlessly.

- Eliminating Technical Barriers: With Clave, users don’t need to understand blockchain, decentralized exchanges (DEX), or gas fees. Our intuitive UI and UX ensure that if you can use the internet, you can navigate Clave with ease.

- Leading Key Management System: Clave integrates hardware-level security with versatile recovery options, setting the standard for key management in the crypto industry. This ensures that user assets are not only secure but also easily accessible.

- Optimal Yield Opportunities on ZKsync Era: Instead of searching through countless pools, Clave curates active pools with significant TVL and favorable APR, presenting users with the best yield opportunities without the hassle.

- Minimized Impermanent Loss Risks: Recognizing that impermanent loss is a major concern for retail users, Clave exclusively offers pools that have minimal or no impermanent loss risk, providing a safer DeFi experience.

By addressing these challenges, Clave currently secures $2 million worth of assets, with nearly 90% of these assets actively utilized in the Earn Hub. This demonstrates the impact of solving UX issues on encouraging greater use of DeFi products.

We’re not just building a wallet because of blockchains—we utilize blockchains to provide access to open finance and unlock new opportunities that traditional finance simply cannot offer. Clave is redefining the way users interact with DeFi, making it simpler, safer, and more accessible for everyone.

About Clave

Clave is an easy-to-use, non-custodial smart wallet powered by Account Abstraction and the hardware-level security elements (e.g., Secure Enclave, Android Trustzone, etc.) to simplify the onchain experience for the next billions. By empowering users with a user-friendly and secure bridge to seamlessly integrate their assets into everyday life, Clave delivers a comprehensive fintech solution, ensuring a holistic financial experience for all.

Connect with Clave:

Website | Download Clave | X (Twitter) | LinkedIn | Farcaster | Discord | Telegram | Marketing Inquiries | General Mail